Canadian homeowners are green with envy over the fact our neighbours to the south are allowed to deduct the interest paid on their mortgages from their taxes. Is it possible to do the same thing here?

I received an elegant little flyer in my mailbox the other day. It was a small glossy fold-over, and it had a quality look and feel to it. The only text on the front flap of the flyer asked me a provocative question: "Is your mortgage tax deductible?" The inside of the flyer told me that I could learn how to collect tax refunds from my mortgage loan. "Canadian homeowners are entitled to collect Tax Refunds from their mortgage payments under Canada Revenue Agency (CRA) guidelines for 'Cash Damming'.

By following CRA's specific guidelines for borrowing and investing, you will claim thousands of dollars in Tax Refunds every year from your mortgage." The small flyer mentioned "Tax Refund" five more times, and twice pointed out that I could use my Tax Refund to pay off my mortgage faster. That's pretty exciting,

The biggest single expense of many Canadian families is their mortgage payment, and we've all been making those mortgage payments with after-tax dollars. Many a Canadian has looked across the border in envy at the tax deductibility that Americans enjoy on their home mortgage interest. If it turns out that we can be getting Tax Refunds from our mortgage payments too, well, that's just a no-brainer.

As it happens, I am quite familiar with this topic and strategy, so I can spare you the inconvenience of having to leave the comfort of your home to discover how this works. In fact, I'm going to provide you with all the essential information that you really must know about Canadian mortgage deductibility and Tax Refunds, all in the very next paragraph! How can I possibly do that? By using an enhanced information conveyance technology I like to call No Baloney™.

Ready? Here's what you really need to know about Canadian mortgage deductibility and Tax Refunds: In Canada, when you borrow money to buy your home, you can't deduct the interest. When you borrow money to make certain investments, you may be able to deduct the interest. There. Now that we've covered all the really important stuff, let's review some of the details. First of all, nothing about buying your personal residence is tax-deductible. You don't get to deduct your mortgage interest, there are no special tricks that have escaped your notice, and you will not be getting "Tax Refunds" from your mortgage payments. Period.

That being said, when you borrow money to make investments which have a reasonable expectation of income, you may be able to deduct the interest on the debt. So if you use your home as collateral when you borrow money to invest, you may be able to deduct that interest expense from your income taxes. You could, therefore, have a mortgage with interest that is partially or entirely tax deductible.

However, it's very important to remember two things: (1) No matter how you twist it, turn it, or wordsmith-manoeuvre-it, the money you borrow to buy your principal residence is not tax-deductible; (2) The only way the interest on your home mortgage can be tax-deductible is if you borrow against the equity you already own in your home, and use that money to investment.

The reason it's so very important to be clear about this issue is that borrowing to buy a home is something that most people must do in order to buy a home, and as long as they can afford their mortgage payment, they're psychologically comfortable doing so. They generally don't worry that their money is at risk. In fact, they feel a sense of security about the equity they are building as they pay the mortgage down. Borrowing to invest, on the other hand, is not something that anyone needs to do, and most people are not psychologically comfortable with it. In order for borrowing to invest to make sense, the average long-term, after-tax return on the underlying investment has to be higher than the after-tax interest rate on the loan.

That invariably means taking on investment risk. And for most people, tolerating investment risk is already sufficiently challenging without the added stress of knowing that those investments were made with borrowed money. Think about the recent gyrations in the stock markets, and consider how using leverage might change your emotional response to the hysteria. Don't get me wrong - I'm not picking on leverage as a concept. Using "other people's money" is an age-old investment strategy, it absolutely has its place as a financial planning strategy, and I've used it myself.

What I am picking on is the packaging of leverage - a strategy that inherently adds risk to investing - as a clever and heretofore overlooked way to get tax benefits on your home mortgage. Let's be No Baloney™ clear: For some people, borrowing money to invest may be an appropriate investment strategy. But borrowing money and investing it because you can get a tax deduction on the interest expense is a ridiculous tax strategy.

With the recent scandal of Madoff, it signals that the more people there are managing one's money, the higher the risk there is. Remember the lawyer who ran away with the clients money? So, in conclusion, the above shows when one uses fund managers, they decrease their returns and increase their risk.

With the recent scandal of Madoff, it signals that the more people there are managing one's money, the higher the risk there is. Remember the lawyer who ran away with the clients money? So, in conclusion, the above shows when one uses fund managers, they decrease their returns and increase their risk.

Apologies for the harsh remarks but Beefy Barber is our friend even though he bullies us at times.

Apologies for the harsh remarks but Beefy Barber is our friend even though he bullies us at times.

So, really, dear investors who invested in this counter, keep your eyes peeled on any news on this. BUT, we being extremely irritating, persistent, bo liao and totally curious decided that it shan't end like that. We decided to take a look at Maple Tree Logistics which is another sort of industrial Reit. And..TAaaa DAaaaa....

So, really, dear investors who invested in this counter, keep your eyes peeled on any news on this. BUT, we being extremely irritating, persistent, bo liao and totally curious decided that it shan't end like that. We decided to take a look at Maple Tree Logistics which is another sort of industrial Reit. And..TAaaa DAaaaa....

So can islamic financing save the day for Cambridge? ( Hmm we seem to remember some article back that Islamic financing may not be immune to the credit crisis too?........Just can't find it..)

So can islamic financing save the day for Cambridge? ( Hmm we seem to remember some article back that Islamic financing may not be immune to the credit crisis too?........Just can't find it..)

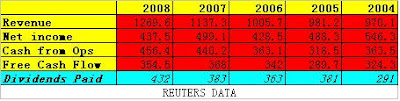

data today. Shit man. Some of our investments SUCK after seeing what she crunched. Anyway, what emerged is so simple to understand but its just that we have been too absorbed into the world of sexy valuation names, such as Sum of Total Parts (SOTP) valuation, Cash Conversion cycle, DCF, PEG ratio e.t.c. . Not that they are useless of cos. What we think and reasoned is that before these ratios are used, the utmost prerequisite is that the investment has to be generating a positive operational cash flow consistently first before one

data today. Shit man. Some of our investments SUCK after seeing what she crunched. Anyway, what emerged is so simple to understand but its just that we have been too absorbed into the world of sexy valuation names, such as Sum of Total Parts (SOTP) valuation, Cash Conversion cycle, DCF, PEG ratio e.t.c. . Not that they are useless of cos. What we think and reasoned is that before these ratios are used, the utmost prerequisite is that the investment has to be generating a positive operational cash flow consistently first before one "owed" by the customers to be paid say in 6 months time. What if the customers default? This sales revenue is then not realised but still recorded as net income previously. Similarly, net income is often contaminated with depreciation expense which is non-cash but purely an accounting concept. So if a company is generating a boatload of cash but if it is capital intensive, then net income will be seen as very little. To clear all this fluff, including management's easy manipulation of net income, one has therefore to look at the Cash from Operations. Or to be more conservative, Free Cash Flow from Operations from a reasonable amount of time period, say 4-5 years or more.( Deducting Capital Exp. from Cash from Operations.)

"owed" by the customers to be paid say in 6 months time. What if the customers default? This sales revenue is then not realised but still recorded as net income previously. Similarly, net income is often contaminated with depreciation expense which is non-cash but purely an accounting concept. So if a company is generating a boatload of cash but if it is capital intensive, then net income will be seen as very little. To clear all this fluff, including management's easy manipulation of net income, one has therefore to look at the Cash from Operations. Or to be more conservative, Free Cash Flow from Operations from a reasonable amount of time period, say 4-5 years or more.( Deducting Capital Exp. from Cash from Operations.) So, we decided to look at Singapore Press Holdings. Recently, 2 analysts have been stating a BUY call for this counter, including a consensus recommendation calling for a near buy. Its easy to agree with them. Straits Times Newspaper, Business Times everywhere and they should be recession proof, right. Let's look at their data. ( You can find the data at

So, we decided to look at Singapore Press Holdings. Recently, 2 analysts have been stating a BUY call for this counter, including a consensus recommendation calling for a near buy. Its easy to agree with them. Straits Times Newspaper, Business Times everywhere and they should be recession proof, right. Let's look at their data. ( You can find the data at

Wondering why their revenue have been increasing so remarkably but their net income seem to be going no-where, and their Cash from Operations is bobbing up and down the water. Their FCF seem to have the longest breath, staying submerged, only coming up for some fresh air in year 2004. Come to think of it. Does SPH really have an investment moat? It's great they came up with STOMP , Digital Newspaper ...but...is that enough?

Wondering why their revenue have been increasing so remarkably but their net income seem to be going no-where, and their Cash from Operations is bobbing up and down the water. Their FCF seem to have the longest breath, staying submerged, only coming up for some fresh air in year 2004. Come to think of it. Does SPH really have an investment moat? It's great they came up with STOMP , Digital Newspaper ...but...is that enough?

Whenever the Beefy Barber wants us to help him, we notice his biceps start bulging slightly. Barber wanted to know if Macquarie Infrastructure is a good buy as the price has dropped from an all time high of $1.23 to $0.295. He also mentioned about the very high dividends yield of about 24.5% (based on dividends of 7.25cents on market price of $0.295). But he is confused, he says. Lately, instituitions such as Capital Group has been reducing their stake from 7.0159 % To 6.9547 % . Macquarie has been reducing from 11.08 % To 10.71 %. BUT Directors such as Lee Suet Fern and Heng Chiang Meng are buying up shares. So what's up? We decided to go together to the Macquarie Seminar on 4 Dec 2008 to learn more. Frankly, we came out non the wiser. What was mentioned is exactly what has been announced on the SGX website and we won't elaborate more. We remembered only the speaker saying that the Catalyst of the plunge was due to Hedge funds who dumped around 10% late last year and Lehman's collaspe and something of a conservative estimate that the dividends will be expected to be 6 cents next year ( 20.3% dividend yield) and that once corporate debt has been repaid, MIIF will start to increase dividends again and that there is going to be a change of depreciation method from a straight line method to a units of production method for Hua Nan Expressway. Hiyah...don't understand the Australian Dudes slang!!!

Whenever the Beefy Barber wants us to help him, we notice his biceps start bulging slightly. Barber wanted to know if Macquarie Infrastructure is a good buy as the price has dropped from an all time high of $1.23 to $0.295. He also mentioned about the very high dividends yield of about 24.5% (based on dividends of 7.25cents on market price of $0.295). But he is confused, he says. Lately, instituitions such as Capital Group has been reducing their stake from 7.0159 % To 6.9547 % . Macquarie has been reducing from 11.08 % To 10.71 %. BUT Directors such as Lee Suet Fern and Heng Chiang Meng are buying up shares. So what's up? We decided to go together to the Macquarie Seminar on 4 Dec 2008 to learn more. Frankly, we came out non the wiser. What was mentioned is exactly what has been announced on the SGX website and we won't elaborate more. We remembered only the speaker saying that the Catalyst of the plunge was due to Hedge funds who dumped around 10% late last year and Lehman's collaspe and something of a conservative estimate that the dividends will be expected to be 6 cents next year ( 20.3% dividend yield) and that once corporate debt has been repaid, MIIF will start to increase dividends again and that there is going to be a change of depreciation method from a straight line method to a units of production method for Hua Nan Expressway. Hiyah...don't understand the Australian Dudes slang!!! Anyway, as the Barber was more interested in the dividends, which is the meat of this investment, we decided to compile a chart, showing the Distributions of each of the underlying compared with the risk ( gearing) of each of this business. We reasoned that this would be helpful to Barber as any collaspe of any one of the businesses will mean no distributions from that business and therefore a reduction in dividends.

Anyway, as the Barber was more interested in the dividends, which is the meat of this investment, we decided to compile a chart, showing the Distributions of each of the underlying compared with the risk ( gearing) of each of this business. We reasoned that this would be helpful to Barber as any collaspe of any one of the businesses will mean no distributions from that business and therefore a reduction in dividends.

Please note that the distributions used above in the chart is based on operational dividends, excluding special, one -off ones. As can be seen from the diagram above, if Miao Li or Hua Nan were to collaspe, since their distribution contribution is so minute there should not be a material impact to the dividends received. (assuming fees and charges remain the same),especially Miao Li with the highest gearing.CAC and MEIF is quite risky and their distributions to MIIF is quite substantial.

Please note that the distributions used above in the chart is based on operational dividends, excluding special, one -off ones. As can be seen from the diagram above, if Miao Li or Hua Nan were to collaspe, since their distribution contribution is so minute there should not be a material impact to the dividends received. (assuming fees and charges remain the same),especially Miao Li with the highest gearing.CAC and MEIF is quite risky and their distributions to MIIF is quite substantial.

Cash = $17,428,000 (ABOVE)

Cash = $17,428,000 (ABOVE)  From above, it is stated that 69.68% represents 359,731,154 shares. This means the number of shares outstanding for Singapore Food is 516,261,702 (100%)

From above, it is stated that 69.68% represents 359,731,154 shares. This means the number of shares outstanding for Singapore Food is 516,261,702 (100%)

It's a little comfort to know that they do not charge performance fees that quarter ( from beginning of year 2008 to 31 March 2008), given that they have unrealized loss. But isn't it such a great business to have, lose money, i don't get bonus(Performance fee), win money, i get bonus(Performance fee). All in all, portfolio profit or loss...i still get money(Management fees), only how much money (fees) i get.

It's a little comfort to know that they do not charge performance fees that quarter ( from beginning of year 2008 to 31 March 2008), given that they have unrealized loss. But isn't it such a great business to have, lose money, i don't get bonus(Performance fee), win money, i get bonus(Performance fee). All in all, portfolio profit or loss...i still get money(Management fees), only how much money (fees) i get.

Since we were looking at these 2 companies, we decided to look at some other ratios just out of curiosity again ( since it is so simple to do, so why not?), and it had nothing to do with which coffee tasted better.

Since we were looking at these 2 companies, we decided to look at some other ratios just out of curiosity again ( since it is so simple to do, so why not?), and it had nothing to do with which coffee tasted better.

Based on Colliers International data above, it is logical to assume that the rental income growth rate g of industrial properties is 0%, by looking from 2001 to 2006F. ( just a cursory glance, she did not do a regression line. Keep it simple. It looks negative actually but let's be nice.).

Based on Colliers International data above, it is logical to assume that the rental income growth rate g of industrial properties is 0%, by looking from 2001 to 2006F. ( just a cursory glance, she did not do a regression line. Keep it simple. It looks negative actually but let's be nice.). Based on the above from SGX, the average dividends, D, of Cambridge Industrial Trust for 2007 and 2008 is $0.0616.

Based on the above from SGX, the average dividends, D, of Cambridge Industrial Trust for 2007 and 2008 is $0.0616.

Using Excel spreadsheet and plugging in the values, the Fair Value (V) for a Cambridge Industrial Trust share is $ 1.00341. Thats the maximum amount one should pay and it assumes that Cambridge is able to sustain the average occupancy of its premises currently. It also assumes that the rentals do not drop and stays constant. It also assumes no exceptional things like volcanic eruptions or earthquake or fire or Tsunami or Terrorist attack happens on any of its site. So the market price currently as of close 28 Nov 2008 is $0.205. Is it enough for you?

Using Excel spreadsheet and plugging in the values, the Fair Value (V) for a Cambridge Industrial Trust share is $ 1.00341. Thats the maximum amount one should pay and it assumes that Cambridge is able to sustain the average occupancy of its premises currently. It also assumes that the rentals do not drop and stays constant. It also assumes no exceptional things like volcanic eruptions or earthquake or fire or Tsunami or Terrorist attack happens on any of its site. So the market price currently as of close 28 Nov 2008 is $0.205. Is it enough for you?