The How-to article we are writing today is drawn from many sources, such as stockfundatalk (check out this blog..its fantastic!), investopedia,wikipedia, our teammates, Analyst reports (yes..we know), textbooks..e.t.c. SGDividends just simplified them and modified them using a Singapore example. So read on ...join us in a quest!

Number 1: Adjusted Funds from Operations (AFFO)

Simply: Net income + Depreciation - Capital Expenditure ( Capex and other expenditure that is needed to sustain the business) = AFFO

Huh..si-mi-lan? ( Crude Hokkien for what you mean). This is because real estate asset is different from fixed-plant or equipment assets as property rarely loses value and often appreciates. Therefore, depreciation is added back. We substract Capex as this is a cost that is needed to sustain the business.

Cash Flow Statement

From the above (000s), 5332 ( Net income,1) + 1304 ( Depreciation,2) - 963(Capex) = 5672AFFO figure is utterly useless by itself as everything has a price or value (even my ass, its silky and smooth btw). So, we have to take into consideration how much we pay for it and we use the price of a share.And we find the price/AFFO per share which is equal to: $0.5/(5672,000 divided by 607,239,808ABOVE) = 0.019.

This figure is utterly useless by itself again..unless you compare the figures with other Reits.

Number 2:Use Dividend Yield

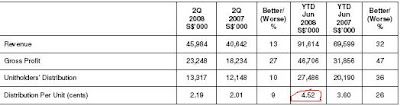

Simply: Price of a share divided by total annual dividend.(Thanks ZhuangZi for alerting us on the striked out mistake.)Total Dividend divided by the price of a share. See below table. YTD 2008 the distribution per unit(DPU) is 4.52 cents. Since this financial statement is reported for 30 June 2008, this DPU is for the first 6 months. Therefore, 4.52 X2 = 9.04 cents. This is divided by S$0.5 to give a percetage of 18.08%. ( actually, for a faster way to get this figure, just go to SGX-REIT Data to get it.)

Compare with other REITS to see which one pays more. ( past performance though may not be replicated again ....we wanna say)

Number 3:Net Asset Value.Now you have it! Its CHICKEN FEET, DON'T YOUR THINK!

No comments:

Post a Comment