Actually, its simple. The answer lies in whether the company or sector is really growing when we deem it a growth stock that justifies a high P/E. Therefore a measure called PEG ratio emerges which takes into account the growth factor. ( [Price/earnings] divided by Estimated Growth per share). The lower the PEG ratio, the better.

Now, what if a company has a low PEG ratio and a low dividend yield, while another company has a high PEG ratio and a high dividend yield. Which is a better investment now? Confused? Enter the pegividend ratio which takes into account the dividend yield too.

PEGIVIDEND RATIO =

([Price/earnings] divided by [Estimated Growth per share + dividend yield]).

The beauty of the pegividend ratio is that it can be used to compare companies from different industries/sectors unlike when using the P/E ratio which is commonly used to only compare companies from the same sector such as TADA..the telecoms industry:

Let's put this into practice, shall we? Let us compare Singapore Airlines with Keppel Corp. Here we go!

Let's put this into practice, shall we? Let us compare Singapore Airlines with Keppel Corp. Here we go!

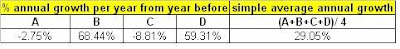

Data For Singapore Airlines ( A Great Way to Fly!)Above

Data for Keppel Corp ( Remember Christopher Lee as the iceman in the channel 8 show!) above

Data for Keppel Corp ( Remember Christopher Lee as the iceman in the channel 8 show!) abovePEGividends ratio for SIA = 6.86 divided by (29.05 + 14.91) = 0.156

PEGividends ratio for Keppel = 6.10 divided by (29.73+6.88) = 0.167

SIA wins! ( marginally though. Also the dividends yield we use here is for the recent year, according to reuters. It may be more prudent to take the average dividend yield among several years, such as {( year 1 dividends + year 2 dividends + year 3 dividends) divided by 3 years} divided by the current price of the share so as to smooth out the lumpiness of the dividends.)

SIA wins! ( marginally though. Also the dividends yield we use here is for the recent year, according to reuters. It may be more prudent to take the average dividend yield among several years, such as {( year 1 dividends + year 2 dividends + year 3 dividends) divided by 3 years} divided by the current price of the share so as to smooth out the lumpiness of the dividends.)

The PEGividend ratio method is from Ryan Barnes who has worked with Merrill Lynch, Charles Schwab, Morgan Stanley and many others as an institutional trader. You can check out his site at http://epiphanyinvesting.com/.

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

No comments:

Post a Comment