This reason is not new actually..think we read it in a book initially and it makes sense to us. It suggests that the US stock market will not be able to see as good a returns as the past due to the mandatory withdrawal of US citizens of their 401Ks at age 70.5years. Just in case, as a Singaporean and you are not familiar with 401Ks, its like a retirement account, similar to our Singapore Supplementary Retirement Scheme (SRS) which was incepted somewhere in year 2001. Below is a summary timeline of 401Ks..

Just a minor additional point. The US government temporary suspended the mandatory withdrawal of 401Ks for year 2009 and thereby effectively postponing such withdrawals to a later date, giving the explanation that forced withdrawals in such current environments would cause a realised loss for retirees. That makes sense. But another additional reason, in our opinion, is that it would cause additional downward pressure on US stock prices. Duh.....

So great, all this, baby boomers, postponed mandatory withdrawals should just add to the relatively sub-par performance of the US stock market in the future...don't you think?

Updated in response to the first comment.

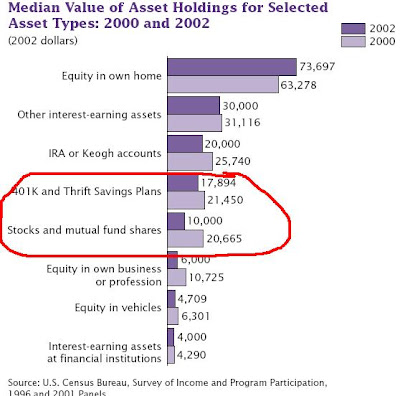

A random search brought up this chart by the US Census Bureau. This is showing data in year 2000 and 2002. Let us focus on year 2002.

As can be seen below the amount of stocks and mutual funds US persons are holding are USD20,665. The amount in 401K is USD21,450. So, the amount of 401K is not insignificant. Granted, not all 401K are in stocks....

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

No comments:

Post a Comment