I have consolidated all of my new FHA Loan Posts, VA Loan Posts, and other Jumbo Loan posts and updates into our main blog,

vandykmortgage.blogspot.com. This will make it easier to keep track of all the new loan program changes as they come down the pike.

For the best uses of FHA loans, VA Loans, Conforming Loans, VA Jumbo Loans, FHA Jumbo Loans, and Conforming Jumbo loans check back with us often. I will update often on new ways to utilize these Government Jumbo Loan programs to achieve your goals and satisfy your needs.

Many people have found that a VA Jumbo Home loan or FHA Jumbo Home Loan is the best solution to their home purchase or Home Refinance needs. Still, many more are unaware that the modernization of these programs can now help millions into safe, secure, and affordable financing.

Working with an experienced VA Direct Lender or FHA Direct Lender such as Brian Skaar and VanDyk Mortgage has it benefits. We have been doing Government loans (FHA & VA) since 1987. We aren't learning the programs, we are making them work for you.

Our FHA Home Loans are available up to $729,750 (depending on county) and our VA home Loans are available up to $1,094,650 (depending on county). The current cap on Conforming Jumbo loans, both Fannie Mae Jumbo (High Balance) or Freddie Mac (Super Conforming) is $729,750, the newly restored loan limits for 2009. Please visit

http://www.vandykfunding.com/ to see the limits for your county.

If you would like to Purchase or Refinance your home with a VA loan, the new 2009 VA loan limits go as high as $1,094,625 in some counties. To find out the loan limit for your county,

click here. VA Loans can refinance your

non VA loan into a safe, secure, and affordable VA home loan. Even up to $1,094,650. We can even leave your existing second mortgage in place with out regard to the total Combined Loan to Value (case by case basis, call for details).

VA Jumbo Loan amounts are those from $417,001 up to $1,094,650. (depending on county).

FHA Loans can also offer refinance options for your non FHA loan into a safe, secure, and affordable FHA home loan, even up to $729,750. We can even leave your existing second mortgage in place with out regard to the total Combined Loan to Value (case by case basis, call for details). FHA Jumbo Loan amounts are those from $417,001 up to $729,750 (depending on county).

Call the Government Loan Experts at VanDyk Mortgage today at 866-900-2342.

http://www.vandykfunding.com/ VanDyk Mortgage has been making FHA & VA loans since 1987. We are a HUD recognized Full Eagle FHA DE underwriter and FHA Direct Lender.

VanDyk Mortgage is also a Proud VA Direct Lender. Go with the Government Loan Pros, go with VanDyk. Visit us at

http://www.vandykfunding.com/ or call Brian Skaar direct at 760-752-4480 for help with your VA or FHA loan. We are your VA Jumbo Direct Lender and FHA Jumbo Direct Lender and we offer

FHA,

FHA Jumbo, FHA Manual Underwrite, FHA Jumbo Streamline refinance, FHA Jumbo Purchase, FHA Streamline, VA, VA Streamline, VA Jumbo purchase, VA Jumbo Refinance, VA Cashout refinance,

FHA Rehab 203K,

VA, Conforming &

Jumbo Loans.

We serve the following areas for VA, FHA and Conventional loans:

California,

Southern California,

Northern California,

Washington,

Texas,

Georgia,

Florida,

San Diego, San Marcos, CA, WA, GA, FL, MO, MI, TX, Carlsbad, Oceanside, Vista, Escondido, Fallbrook, Bonsall, Riverside, Los Angeles, Orange County, Irvine, Corona, Anaheim, Santa Ana, Seattle, Washington, Bellevue, Kirkland, Redmond, Lynnwood, Olympia, Tacoma, Puyallup, Buckley, Auburn, Kent, Federal Way, Seatac, San Francisco, San Jose, Carson, Gardena, Hawthorne, Lawndale, Inglewood, Ladera Heights, View Park, Windsor Hills, Baldwin Hills, Fox Hills, Culver City, Beverly Hills, Malibu, Santa Monica, Brentwood, Calabasas, Encino, Oakland, Bel Air Estates, Palos Verdes Estates, Rancho Palos Verdes, Rolling Hills, Rolling Hills Estates, Manhattan Beach, Redondo Beach, Hermosa Beach, Torrance, Sacramento, Stockton, Bakersfield, Fresno, San Marcos, San Diego, Rancho Bernardo, Carlsbad, Escondido, Poway, Oceanside, Vista, Encinitas, Carmel Valley, Scripps, Tierra Santa, El Cajon, La Jolla, Chula Vista, National City, San Ysidro, Santee, Eastlake, Ramona, Long Beach, Artesia, La Palma, Cerritos, Compton, Lynwood, Bellflower, Temecula, Murrieta, Southern California,

Northern California,

Washington, Everett, Lynnwood, Tacoma, Kent, Federal Way, Auburn, Renton, Bellevue, Redmond, Kirkland, Whittier, Santa Fe Springs, Downey, Irvine, Newport Beach, Los Angeles, San Bernardino, Riverside and Orange County.

VanDyk Mortgage is your FHA Lender & VA Lender of choice.

Let's look at the current population pyramid of US as of year 2009. ( taken from their Censeus Bureaus....don't play play and who says Geography is useless, we will punch you..see how useful it is!)

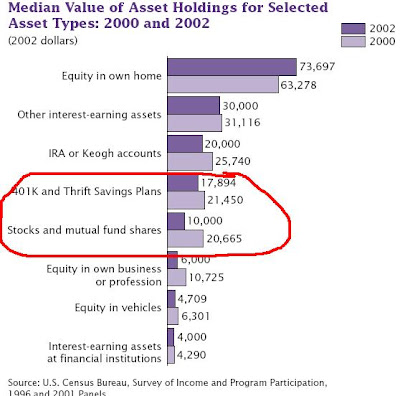

Let's look at the current population pyramid of US as of year 2009. ( taken from their Censeus Bureaus....don't play play and who says Geography is useless, we will punch you..see how useful it is!) It should be noted that the inception of 401Ks was around year 1978. That means that as of current year 2009, about 31 years have passed, enough time for US citizens to have amassed a large amount of equities or mutual funds and other securities in their 401Ks. Add to that, as can be seen from the population pyramid above, the baby boombers are coming of age. At around 6-10 years time, the currently 60-64 age group would have to begin mandatory withdrawals, which means selling of US securities. Wouldn't this add to the downward pressure on stock market prices?See the fattening of the population pyramid downwards.

It should be noted that the inception of 401Ks was around year 1978. That means that as of current year 2009, about 31 years have passed, enough time for US citizens to have amassed a large amount of equities or mutual funds and other securities in their 401Ks. Add to that, as can be seen from the population pyramid above, the baby boombers are coming of age. At around 6-10 years time, the currently 60-64 age group would have to begin mandatory withdrawals, which means selling of US securities. Wouldn't this add to the downward pressure on stock market prices?See the fattening of the population pyramid downwards.

In layman speak, the above chart is basically showing how fast and furious the US Feds have been buying securities ( mortage-backed,treasuries, e.t.c). When the US Feds buy securities, they use US dollars to pay for it, therefore, effectively increasing the money supply into the system. Don't you think the spike is kinda scary?

In layman speak, the above chart is basically showing how fast and furious the US Feds have been buying securities ( mortage-backed,treasuries, e.t.c). When the US Feds buy securities, they use US dollars to pay for it, therefore, effectively increasing the money supply into the system. Don't you think the spike is kinda scary? To understand what gibberish we are talking about, one needs to understand the purchasing power of cash . It refers to the amount of real goods and services that a person can buy with say $1 fiat money. Therefore, its not correct to measure whether one has become wealtheir by looking at one's bank account, its more important to see how much goods and services one can buy. See the second chart above.

To understand what gibberish we are talking about, one needs to understand the purchasing power of cash . It refers to the amount of real goods and services that a person can buy with say $1 fiat money. Therefore, its not correct to measure whether one has become wealtheir by looking at one's bank account, its more important to see how much goods and services one can buy. See the second chart above.