It's net profit is an astonishing 64%!! Not surprising actually when one thinks of it, just think of how cheap semen is and embryos.

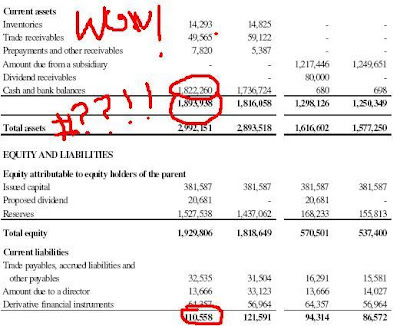

Looking at the balance sheet, the current asset is much much larger than the current liabilities. And look at its Cash warchest! It is much more than the current liabilities. For sure, this is one company that does not require to take on any loan during this credit crunch.Just to confirm, we looked at another part of the report, just in case there was a printing error. (Just joking, see below)Voila! It has nothing to repay within this year.

We therefore proceeded to look at the Cash Flow Statement, and guess what again, it has a rich, sustained FREE cash flow. Sperm is indeed cheap. This company will only continue to increase its already gargantuan cash balance.

So let's see how cheap is this company. See below. Its Net Tangible Asset 246RMB which is approximately 49cents and what is the now? 35 cents. Cheap!A recent acquisition of a joint venture company with the Heilongjiang Animal Breeding Centre of an amount of SGD$28.6 million which it paid for entirely with cash. Objective of acquisition has got something to do with sourcing for superior breed Holsteins from Heilongjiang and neighbouring provinces instead of Australia to save cost. ( A good sign eh....)

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

No comments:

Post a Comment