While blue skies and picturesque lakes certainly drew people to this valley, its postcard-perfection hasn’t been enough to stave off the effects of worldwide economic trouble.

The first signs came when water-cooler talk changed from estimating real estate gains to lamenting losses in retirement plans and higher costs for just about everything.

Legitimate concerns about the state of the economy made consumers nervous and more thrifty, despite assurances of “strong economic fundamentals” from Canada’s mortgage economists and political leaders.

And then came the more literal signs. For Sale boards started to pop up in front of houses and never left.

Home owners and speculators who once bragged it only took a week or so to sell their houses or condos are now just boasting “reduced” or “new price” on their sale signs.

While economists were slow to acknowledge what most could surmise by a walk through their neighbourhoods, there are now significant rumblings of a slump in prices for houses this side of the border.

Some are going so far as to call it a housing recession, as realtors and sellers are already well into contingency plans that will allow them to ride out the storm.

Where the market is going

A report last month from Central 1 Credit Union said the province’s housing market in a recession, and it’s not expected to be a quick dip.

According to Helmut Pastrick, the bank’s chief economist, housing sales across B.C. will decline by 30 per cent this year, 17 per cent next year and five per cent the year after that. And prices will be in tow.

Prices will continue falling from their March 2008 high into next year, bringing the provincial median sales price down 13 per cent to $310,000 in 2009 and by a further five per cent in 2010—in total nearly an 18 per cent drop.

Things are supposed to look up later that year following a sales turnaround and relaxing credit conditions. “Recession in any industry—housing, auto or lumber—is a period where the industry experienced sustained declines in output and in prices, and that fits what’s happening in B.C.,” said Pastrick.

He noted that the Okanagan won’t be exempt from any downward trend.

“All regions are participating in this to largely the same degree and the trends and conditions are very similar throughout the province, which is usually the case when we have major economic event or factor coming into play.”

That major economic effect is, of course, the financial crisis in the United States, which has put a crimp on the many industries that are finding it difficult to access credit and move operations forward.

In turn, its stagnated economic growth across the U.S., and to some degree, in Canada hypotheque as well.

“As the general economy suffers and slows down, it has feedback into housing sector.”

Over at the B.C. Real Estate Board, chief economist Cameron Muir is on the same page, although his group’s fall forecast projects declines in the area of 10 per cent, as opposed to 18.

According to him, Okanagan home prices should be down to 2006 levels by the end of the year and remain flat throughout 2009.

“Throughout the province there’s quite an imbalance between supply and demand. There are more homes for sale, while home buyers have dropped off considerably from a year ago, and the combination of those two factors has put downward pressure on prices,” he said.

Muir said real estate markets most conducive to recreation and investment buyers— such as the Okanagan—will be a little bit worse off than major markets, like Victoria and Vancouver, simply because of the fact that there are fewer investment and recreation home buyers around now.

Kelowna, he said, is well diversified but part of the responsibility of the downward trend can be placed upon the same group who helped drive up prices.

Just as fast as oil money flowed into the Okanagan, it’s started to dry up in relation to the Albertan housing market flattening.

Calgary, for example, saw their housing prices start to tumble months before B.C. felt any pangs of contraction, said Muir.

Basically, that’s meant those who were leveraging gains in home equity for new home purchases are out of luck and, as a result, no longer looking to buy.

But, that’s not what Kelowna residents will have to worry about.

The real test of how this region will fare is the level to which residents are able to comfortably live and work here, Muir said.

“What we really need to look at is what are the financial conditions and the confidence of people who live work and raise their families there because they are the ones who drive positive demand,” he said.

“Unlike the U.S., the financial condition of households in this province, and in Kelowna, are on relatively strong footing.”

B.C. isn’t seeing a sharp increase in foreclosure activity, the unemployment rate is staying quite low from a historical perspective as are interest rates, Muir said.

“Without a collapse in household financial positions, homeowners are not in a position where they have to sell at any price like they are in the U.S.”

According to Muir, the biggest stumbling block is consumer confidence, which is at the lowest it’s been in 26 years.

Realtors

A lack of consumer confidence is something local realtors are far too familiar with.

Ian Share, of the Century 21 office in Glenmore, has seen a sharp decline in sales, although he said he remains busy. The problem, as he sees it, is that sellers are having a hard time adjusting to the market. A house that may have flown off the market a year ago for a cool $500,000 isn’t going to have the same appeal today as buyers have far more to choose from and are taking their time.

While his focus is on North Glenmore, Lake Country and Phoenix, Arizona, he says only the latter market is seeing eager buyers.

Share tapped into the Phoenix market successfully to pursue an opportunity he saw resulting from the U.S. financial crisis.

“The conclusion you can start to draw is that the real estate market is adjusting and correcting massively and that the buyers that are willing to step up to the plate are few and far between,” he said.

“Generally they consist of investors picking up rental properties and other clients who are relocating here for work.”

Drawing upon some of his office stats, Share also pointed to a much sharper decline than the 10 or 20 per cent the economists are forecasting—and it’s happening now.

Share was the listing agent on one of only two homes that sold in Lake Country (excluding Carrs Landing) last month—118 were listed.

While the lack of sales may be disturbing, Share pointed out it’s actually the pricetag changes that are the most dramatic, citing the two Lake Country listing sales examples.

“One was originally listed for $549,000 and sold for $400,00—that’s a difference of $149,000,” he said.

“The other was originally listed for $449,000 and sold for $351,500—that’s a difference of $97,500.”

In the months leading to the dry spell, Share added only nine single family homes sold and the average price difference from the original list price to the sold price was $37,966, whereas this last month the average price difference was $123,250.

“Even though we’re been reassured that our banking system is solid and that our economy is ticking along nicely…in my opinion we’re crazy to think that Canada is impervious to some sort of significant adjustment in our economy and in the real estate market,” he said.

That said, this is the time for buyers to gather their resources and plunge into the market and time for sellers to start listening to their agents, Share believes.

“Sellers that are in this current market generally dump realtors if they haven’t sold their homes during the listing period, and they probably most likely figure they’ll just get someone else that will get the job done,” he said.

“The majority of time it may not be the fault of the realtor if he or she priced it correctly and aggressively to start with…If it isn’t priced right in this market then both the realtor and the seller get frustrated as they’re simply just spinning their wheels.”

Over at Coldwell Banker, Horizon Realty, Paul Pofpnikoff is also feeling the pinch.

Like Share, he’s finding a way to leverage the conditions of the current market so they work to his benefit and opened a sideline project.

Focusing on developers who have a property they need to market, he’s created a website—www.propertyexchangekelowna.com—that lures potential buyers from markets as far flung as Europe.

He has to go there “to create opportunities” because he admits things have dried up locally.

“I know realtors have to have this rosy picture, but currently there aren’t many buyers and I am finding many people that could are resorting to renting their place rather than selling it,” he said.

“I have had vendors calling about listing, and quickly changing their mind, saying, ‘The price we’d be getting wouldn’t be good enough—we’ll rent for a year or two until the market gets better.’”

It’s something “everyone” is seeing and he too blames it on the problems in the U.S., the “troubling effect it’s had on the psychology of the buyer.”

Reduce the price, or rent?

For contractor Robert Tissington, building, buying and selling homes has been a way of life for as long as he can remember.

It’s what his dad and grandfather did, and he followed their lead into the local market a few years ago.

His first house—among several properties he owns and can’t currently sell—was purchased in Kelowna’s North End a few years ago for about $200,000.

He added a carriage house to it for about $130,000 and got ready to move into another place.

When he listed his property with a real estate agent, he was told to list somewhere in the area of $700,000, which he thought to be quite high, but competitive. It didn’t move. His price dropped by nearly 10 per cent and it still didn’t move.

With that, he decided to take it off the market.

“A year ago I thought selling it for about $550,000 would have been brilliant, but it’s the type of property you hang onto,” he said.

His property is a good rental—a market that’s not shrinking—and will continue to earn as the real estate market fluctuates.

In the meantime, he didn’t see the point of putting his life on hold waiting for the property to sell.

“The amount of tire kickers you have to go through—the people who want to see all the houses, but aren’t prepared to buy, even if they think they are—just aren’t worth it.”

He’s comfortable with the idea of riding out the changes in the meantime, and as a contractor thinks he sees a lot of opportunity in the current market—if not to sell, to buy.

“You just sort of acquiesce, give it a reasonable chance, and go off in another direction,” he said.

“Now I feel great about the decision, but you have to be moving forward or backward.”

Tissington said that the current market should have been expected, as Kelowna functions on a six-year cycle.

“Prices peak and everybody lists when they sense it’s the end of cycle and then there’s a glut of houses on the market,” he said. “The last one was in 2001, and before that in 1993-94.”

When he bought his house for $212,000, that seemed like an incredible amount of money for an old house, but he pointed out it was worth the investment.

“This whole economic situation is running alongside what may have been a natural price adjustment anyway,” he said.

The good news

Property owners may be in a pinch, but this region has suffered the pains of rising costs for years.

Reports earlier in the year boasted that young buyers were still entering the housing market with “reduced expectations,” while many complained prices became too restrictive for many to enter the market at all.

Now prices are becoming more competitive. Developers trying to unload units are offering bonuses, rent to own incentives and coming out with a product that’s more attainable.

All in all, it’s something Brenda Moshansky, a director with the Okanagan Mainline Real Estate Board, believes will create some opportunities for first-time home buyers looking to get into the market.

“Properties that are marketed competitively will continue to sell, and with the interest rates where they are, it’s a wonderful time for buyers to get into the market,” she said, adding realtors are working a lot harder to draw interest in their listings.

Moshansky said that the Okanagan and its natural allure will ensure that the prices don’t dip too drastically.

“One thing that’s very unique about this region is that it’s a little bit immune to some of the problems because it’s a destination market,” she said.

“Ski hills are expanding, popular resorts as well as accommodations are coming here and we accommodate a lot of recreational consumers for second homes as well as being a retirement market.”

Although Moshansky knows the economic predictions for the next year, she believes that the market is already correcting itself as fewer listings are starting to come out. “Real estate is traditionally very cyclical,” she said.

“Some people say it’s a six year cycle, others say it’s seven…it will turn around. Real estate is not as volatile as the money market.”

When it will end?

Housing is a high reach industry. Realtors, retailers, builders and architects are just a few who will feel the pinch if the bottom falls out of the market.

Construction has become a major economic driver of this region, and job growth has been substantial, with some estimates being in the area of 94 per cent.

“Usually there is a time delay to response in new construction and housing market conditions after sales decline,” said economist Helmut Pastrick, adding that housing starts are likely to drop off by 30 to 40 per cent next year.

But, things will get better.

“It’s not a downward endless spiral,” said Pastrick.

“There will be forces at play to reverse the downturn and some of them are already beginning to materialize.”

It’s still early in the decline of sales and prices, but by 2009, and 2010, things will get better.

“Lower interest rates, lower mortgage rates and lower prices can stimulate demand so that will set the stage for some improvement in housing sales,” he said.

“It’s open to debate how strong that recovery will be—at this time it doesn’t look that strong, but as long as the decline ends…that’s positive.”

( She is really quite interesting and surprising!And she like to determine the Value of anything. For example, she even determines the value of playing tennis vs spending time with us and she comes up with a figure.) Anyway, she told us that her teacher says females are better at investing and guys suck cos guys monitor the stock market too much and think too much and rationalise too much. She also told us her teacher says its the female species that will bring the world out of recession cos her species spend and spend and spend and spend. We got to admit she is right. Just go to a shopping center near you and see who are the ones spending? Its the girls......

( She is really quite interesting and surprising!And she like to determine the Value of anything. For example, she even determines the value of playing tennis vs spending time with us and she comes up with a figure.) Anyway, she told us that her teacher says females are better at investing and guys suck cos guys monitor the stock market too much and think too much and rationalise too much. She also told us her teacher says its the female species that will bring the world out of recession cos her species spend and spend and spend and spend. We got to admit she is right. Just go to a shopping center near you and see who are the ones spending? Its the girls......

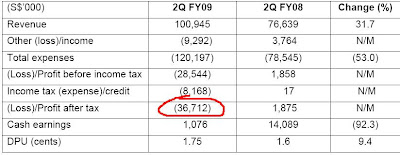

Let's put this into practice, shall we? Let us compare Singapore Airlines with Keppel Corp. Here we go!

Let's put this into practice, shall we? Let us compare Singapore Airlines with Keppel Corp. Here we go!

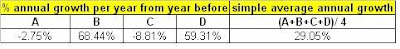

Data for Keppel Corp ( Remember Christopher Lee as the iceman in the channel 8 show!) above

Data for Keppel Corp ( Remember Christopher Lee as the iceman in the channel 8 show!) above

We pulled the data out from Reuters ( let's assume reuters is correct) You can get the reuters data from

We pulled the data out from Reuters ( let's assume reuters is correct) You can get the reuters data from

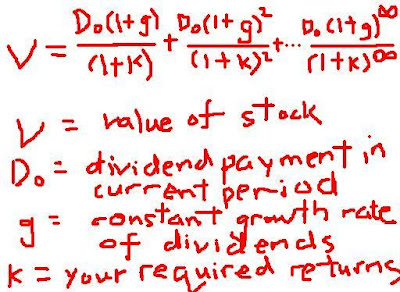

A reader asked us to write about valuing equities using the Discounted Cash Flow method sometime back. It has been long overdued...sorry dude or duddette...we have been busy analysing some stuff of late. Before you read on, we would like to mention that this method entails a lot, a lot and we mean a lot of assumptions and it is highly theorectical. Garbage in- garbage out. Why do you think Research Reports target prices are nearly always way off target? Anyway, its the thought process that counts and not the final target price. Who knows, when thinking through the process..you may actually gain insights on the stock you are researching. So its not useless..this model.

A reader asked us to write about valuing equities using the Discounted Cash Flow method sometime back. It has been long overdued...sorry dude or duddette...we have been busy analysing some stuff of late. Before you read on, we would like to mention that this method entails a lot, a lot and we mean a lot of assumptions and it is highly theorectical. Garbage in- garbage out. Why do you think Research Reports target prices are nearly always way off target? Anyway, its the thought process that counts and not the final target price. Who knows, when thinking through the process..you may actually gain insights on the stock you are researching. So its not useless..this model. Based on the table above, it is logical to assume that they will be giving out at least S$0.0625 in dividends every year from 2009 and beyond. So here comes the DCF formula. Its looks ugly but its actually quite easy. SGDividends will walk you through.

Based on the table above, it is logical to assume that they will be giving out at least S$0.0625 in dividends every year from 2009 and beyond. So here comes the DCF formula. Its looks ugly but its actually quite easy. SGDividends will walk you through.  Figure 1

Figure 1  Figure 2

Figure 2

2)What's with the outages at Basslink and how does Cityspring mitigate operational risk of the subsea cables?

2)What's with the outages at Basslink and how does Cityspring mitigate operational risk of the subsea cables?

In our SingTel

In our SingTel

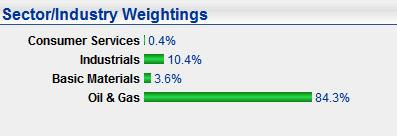

So what is the reason for this stock to be so undervalued relative to its peers. We decided to investigate and could only think of a possible reason, that investors were pricing in a cheaper stock due to the not so favourable history of its management. Read

So what is the reason for this stock to be so undervalued relative to its peers. We decided to investigate and could only think of a possible reason, that investors were pricing in a cheaper stock due to the not so favourable history of its management. Read