As we always believe in understanding what we invest in and absolutely subscribe to the quote by Warren Buffet above, we decided to start a project that seeks to understand the underlying business model of the different industries in Singapore. In this first post of this project, we are looking at the local banking industry in Singapore and compare among them, in the hope, to understand them better. As new information is picked up, we will just add into it. In time to come, we should be looking into Plantation industry , Oil and Gas related Industry in Singapore, Property Development industry,Waste treatment industry, Telecommunications industry e.t.c. As we learn, we share cos sharing is caring. Yeah like real....... Does anyone still believe this sissy crap?

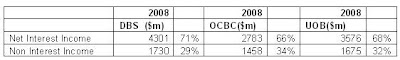

Comparison of income sources between DBS, OCBC and UOB banks.

Net Interest Income - Money earned by banks from taking " low interest bearing" customers deposits to make "higher interest bearing" loans out and earning the interest spread.

Net Interest Income - Money earned by banks from taking " low interest bearing" customers deposits to make "higher interest bearing" loans out and earning the interest spread. Generally, it has been mentioned that non-interest income adds to the stability of the bank due to diversification of income streams. OCBC is therefore considered more diversified. It is not unexpected as they own a very large proportion of Great Eastern which contributes to their Non-Interest Income portion.

Generally, it has been mentioned that non-interest income adds to the stability of the bank due to diversification of income streams. OCBC is therefore considered more diversified. It is not unexpected as they own a very large proportion of Great Eastern which contributes to their Non-Interest Income portion.  Personally, UOB bank presented their breakdown differently from how both OCBC and DBS presented. What does "Investment related" mean? It can mean both "stock broking" and " "Investment Banking"? They also have this component called "Futures Broking" which should fall under "Stock Broking" in DBS or OCBC's way of break down. Maybe the regulators should ensure similar terms used so as to compare more easily.Does Trade-Related under UOB mean "Trade and remittances" under OCBC and DBS? Question Mark?Does "Services charges" under UOB mean "Deposit related" under OCBC and DBS?

Personally, UOB bank presented their breakdown differently from how both OCBC and DBS presented. What does "Investment related" mean? It can mean both "stock broking" and " "Investment Banking"? They also have this component called "Futures Broking" which should fall under "Stock Broking" in DBS or OCBC's way of break down. Maybe the regulators should ensure similar terms used so as to compare more easily.Does Trade-Related under UOB mean "Trade and remittances" under OCBC and DBS? Question Mark?Does "Services charges" under UOB mean "Deposit related" under OCBC and DBS?Comparison of Loans to Customers By Geography

Aaaaargh! Can't find any such breakdown for UOB! Hey what's up man!Can you guys follow the crowd?

Aaaaargh! Can't find any such breakdown for UOB! Hey what's up man!Can you guys follow the crowd? Top 2 industries for DBS is Housing loans and Building and Construction

Top 2 industries for DBS is Housing loans and Building and ConstructionComparison of Customer Deposits ( Cheap Financing for the Banks)

Look at the savings deposit of DBS bank! Actually, its quite obvious. This table is a waste of our time. Shit.

Look at the savings deposit of DBS bank! Actually, its quite obvious. This table is a waste of our time. Shit.Comparison of Non-Performing Assets among the 3 banks

For example, a mortgage in default would be considered non-performing. After a prolonged period of non-payment, the lender will force the borrower to liquidate any assets that were pledged as part of the debt agreement. If no assets were pledged, the lenders might write-off the asset as a bad debt and then sell it at a discount to a collections agency.

Comparison of Staff Headcount and expense of the 3 banks

It was pretty unexpected as we had always thought that DBS, being the biggest local bank would have the most number of employees. Surprisingly, it has the lowest, while UOB has the most number of employees. The total amount that is spent on DBS employees is the highest though and their mean "expense ( this could include other things other than salary)" is $85,541.1, nearly twice their 2 rivals.

It was pretty unexpected as we had always thought that DBS, being the biggest local bank would have the most number of employees. Surprisingly, it has the lowest, while UOB has the most number of employees. The total amount that is spent on DBS employees is the highest though and their mean "expense ( this could include other things other than salary)" is $85,541.1, nearly twice their 2 rivals. OK this post is just to compare the 3 banks for a better understanding of their business. So we did not include Tier 1 ratios and the stuff.

If you like this blog, do help SGDividends by adding us as your favourites via this link,THANK YOU!:

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

No comments:

Post a Comment